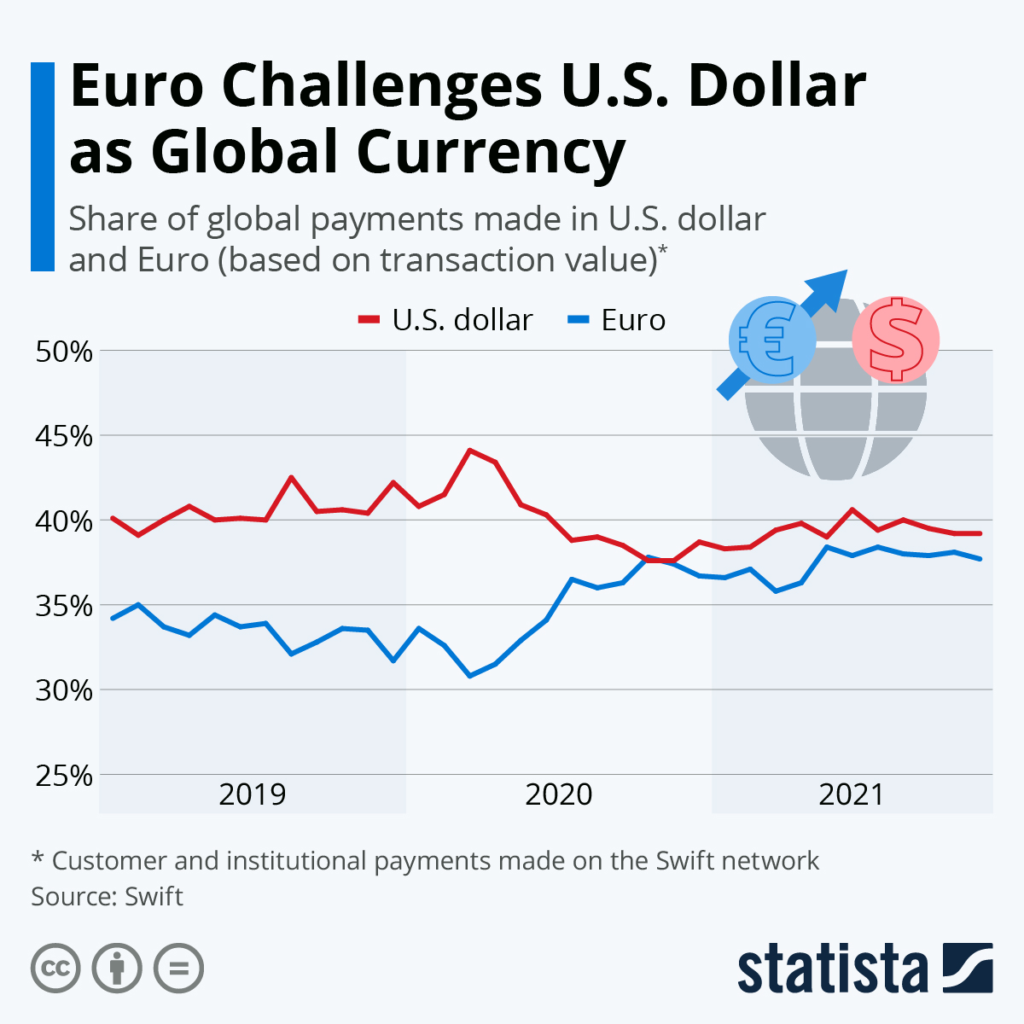

US Dollar vs Euro Predictions: The two major currencies in the world are the U.S. dollar and the euro. They are both heavily utilised in international trade and finance and are both regarded as havens during uncertain economic times.

The euro has lost ground to the dollar recently. This is brought on by a lot of things, including as the European financial crisis, the uncertainty surrounding Brexit, and the robust U.S. economic performance.

But there are now encouraging indicators for the euro. The value of the euro relative to the dollar has increased recently. The recovery of the European economy, the ambiguity surrounding the U.S. presidential race, and the Federal Reserve’s decision to hike interest rates are some of the causes of this.

If the euro continues to rise against the dollar, it is too soon to tell. The recent surge of the euro indicates that the struggle for dominance between the two currencies is still very much ongoing.

The following variables may have an impact on the US Dollar vs Euro Predictions

- Economic expansion: The euro will often gain value against the dollar if the European economy expands more quickly than the American economy.

- Interest rates: The euro will typically strengthen against the dollar if the European Central Bank raises interest rates more than the Federal Reserve.

- Political unpredictability: The euro tends to weaken against the dollar if there is greater political unpredictability in Europe than in the United States.

- Risk tolerance: Those who are less risk-averse will often buy dollars and sell euros.

Which currency is more valuable, the euro or the dollar?

The exchange rate, which defines how much of one currency can be exchanged for another, is often used to assess the worth of currencies like the euro (EUR) and the US dollar (USD). It’s crucial to keep in mind that currency values might alter over time as the conversion rate between two currencies varies depending on a number of variables.

As far as I’m aware, the USD has always been regarded as being stronger than the euro, with a cutoff date of September 2021. This is because of a number of things, such as:

- Global Reserve Currency: The US dollar is currently regarded as the main reserve currency. Significant quantities of USD are held in the foreign exchange reserves of numerous central banks and international organisations. The USD is more valuable and powerful because of the global demand.

- Economic factors: The US economy is one of the biggest and most powerful in the world. The US has historically demonstrated strong economic development, technical innovation, and a stable business environment, all of which have boosted the USD’s value.

The strength of currencies can, however, fluctuate over time depending on economic and geopolitical circumstances, so it’s vital to remember that. Since its launch, the euro, which stands in for a collection of European nations, has become stronger and more respected. The euro’s value in relation to the USD can be affected by the Eurozone’s economic performance, political stability, and market confidence in the currency.

Forecasts and analysis of the euro-dollar exchange rate ?

You know that thing they call the euro/USD exchange rate? Well, as of today, June 20, 2023, it stands at 1.0725. What that means is, if you have one euro, it’s worth about $1.07 USD. So, you can exchange one euro and get around 1.07 dollars in return.

In recent months, there has been a minor upward trend in the euro/USD exchange rate. The recovery of the European economy, the ambiguity surrounding the U.S. presidential race, and the Federal Reserve’s decision to hike interest rates are some of the causes of this.

The euro/USD exchange rate, however, may fluctuate in the future due to a number of reasons. These include the on-going trade conflict between the United States and China, the possibility of a eurozone recession, and the ambiguity surrounding Brexit.

In general, it is anticipated that the euro/USD exchange rate will hold steady in the near future. The exchange rate could fluctuate, though, due to a variety of circumstances.

The following are some variables that may impact the euro/USD exchange rate in the future:

- Economic expansion: The euro will often gain value against the dollar if the European economy expands more quickly than the American economy.

- Interest rates: The euro will typically strengthen against the dollar if the European Central Bank raises interest rates more than the Federal Reserve.

- Political unpredictability: The euro tends to weaken against the dollar if there is greater political unpredictability in Europe than in the United States.

- Risk tolerance: Those who are less risk-averse will often buy dollars and sell euros.

It is crucial to keep in mind that currency values can fluctuate quickly, so it is recommended to verify the most recent exchange rates prior to engaging in any transactions.

The following are some analysts’ predictions for the future of the euro/USD exchange rate:

- Forexlive: Forecasts the euro/USD exchange rate to reach 1.133 by the end of 2023.

- DailyFX: Forecasts the euro/USD exchange rate to reach 1.10 by the end of 2023.

- Trading Economics: Forecasts the euro/USD exchange rate to reach 1.08 by the end of 2023.

It is significant to keep in mind that these are only projections and that the real exchange rate may differ.

Can the euro continue to rise?

Whether the euro will keep rising is difficult to predict with certainty. The euro may, however, continue to gain value against the US dollar in the foreseeable future, according to a variety of considerations.

These elements consist of:

- The improvement in the European economy: The European economy has been growing steadily in recent months, and this is expected to continue in the near future. This could lead to increased demand for euros, which could push up the euro/USD exchange rate.

- The uncertainty surrounding the U.S. economy: The U.S. economy is facing a number of challenges, including the ongoing trade war with China and the potential for a recession. This could lead to increased demand for euros as investors seek a safe haven currency.

- The hawkish stance of the European Central Bank: The European Central Bank has signaled that it is likely to raise interest rates in the near future. This could make the euro more attractive to investors, which could push up the euro/USD exchange rate.

The euro/USD exchange rate, however, may also be influenced by a number of other factors in the future. These consist of:

- The ongoing trade conflict between the United States and China: If this trade conflict has a negative effect on the world economy, it could hinder Europe’s economic growth. This might cause the demand for euros to decline, which would lower the euro/USD exchange rate.

- The potential for a recession in the eurozone: The eurozone is facing a number of challenges, including the ongoing debt crisis in Greece and the potential for a recession. This could lead to decreased demand for euros, which could push down the euro/USD exchange rate.

- Brexit-related uncertainty: The euro/USD exchange rate may be impacted by Brexit-related uncertainty. Without an agreement, the UK might leave the EU and have a negative effect on the European economy, which could slow down economic growth and cause the euro to lose value.

In general, the euro is anticipated to be steady in the near term. The exchange rate could fluctuate, though, due to a variety of circumstances. Before making any decisions about currency conversion, it is crucial to keep an eye on these elements and make sure you are aware of the hazards associated.

Impact of the euro and dollar on global economics: ( US Dollar vs Euro Predictions )

The world’s two most significant currencies are the euro and the US dollar. They are both heavily utilised in international trade and finance and are both regarded as havens during uncertain economic times.

The global economy may be significantly impacted by the dollar’s and euro’s exchange rates. The cost of exporting goods and services from European businesses will increase if the euro is strong. This might cause Europe’s economic growth to slow down. On the other hand, if the dollar is strong, it will be more expensive for American businesses to export their products. The United States’ economy may grow more slowly as a result.

The cost of imports and exports for companies and consumers around the world can also be impacted by the euro and the dollar. Exports from Europe will be more expensive and imports from Europe will be less expensive if the euro is strong. In contrast, if the dollar is strong, imports from the United States will be less expensive but exports to the United States will be more expensive.

The value of other currencies can also be impacted by the dollar and the euro. Other currencies, such the British pound and the Japanese yen, will weaken if the euro is strong. In contrast, a strong dollar will weaken other currencies like the Chinese yuan and the Brazilian real.

Several impacts of the US dollar and the euro on the global economy are listed below:

- Economic expansion: Both the euro and the dollar’s values can have a big impact on how much the US and Europe’s economies expand. A strong euro could cause Europe’s economic development to slow down. On the other hand, a strong dollar can cause the US economy to grow more slowly.

- Trade: Trade between Europe and the US may be impacted by the value of the euro and the dollar. If the euro is strong, American businesses and consumers may pay more for imports from Europe. On the other hand, if the dollar is strong, businesses and consumers in Europe might pay more for imports from the US.

- Exchange rates: The exchange rates of other currencies can be impacted by the value of the euro and the dollar. Other currencies, such the British pound and the Japanese yen, can become weaker if the euro is strong. On the other hand, a strong dollar might weaken other currencies like the Chinese yuan and the Brazilian real.

- Investment: The exchange rates of the euro and the dollar can have an impact on the flow of capital between Europe and the US. A strong euro may increase foreign investors’ desire to invest in Europe. On the other hand, a strong dollar can encourage foreign investors to place their money in the US.

The US dollar and the euro have a variety of consequences on the global economy, but it’s crucial to keep in mind that these are only a few. Several variables, including the monetary policies of the Federal Reserve and the European Central Bank, the status of the global economy, and the political climate in Europe and the US, can affect how these currencies really affect the world economy.

Here are 7 currencies worth more than the US dollar as of June 20, 2023:

- Kuwaiti dinar (KWD): 1 KWD = 3.26 USD

2. Bahraini dinar (BHD): 1 BHD = 2.65 USD

3. Omani rial (OMR): 1 OMR = 2.60 USD

4. Jordanian dinar (JOD): 1 JOD = 1.41 USD

5. Cayman Islands dollar (KYD): 1 KYD = 1.22 USD

6. Swiss franc (CHF): 1 CHF = 1.03 USD

7. Norwegian krone (NOK): 1 NOK = 0.10 USD

- It is important to note that the value of currencies can fluctuate, so these values may change over time.

Euro price to drop in upcoming days? ( US Dollar vs Euro Predictions )

The euro has been losing value in recent months, and a number of reasons could cause it to lose further value in the days to come. These elements consist of: ( US Dollar vs Euro Predictions )

- he ongoing war in Ukraine: The war in Ukraine has caused uncertainty in the global economy, and this has weighed on the euro. The war could also lead to higher energy prices, which would further weaken the euro.

- Monetary policy of the European Central Bank: The European Central Bank is anticipated to increase interest rates in the upcoming months, but at a slower rate than the Federal Reserve. This would cause the gap between the interest rates of the euro and the dollar to increase, which would make the euro less alluring to investors.

- The risk of a recession in Europe: The European economy is facing a number of headwinds, including the war in Ukraine and the energy crisis. This could lead to a recession in Europe, which would further weaken the euro.

There are several elements, nevertheless, that might work in favour of the euro in the days ahead. These elements consist of: ( US Dollar vs Euro Predictions )

The strength of the German economy: The German economy is the largest economy in the eurozone, and it has been relatively resilient to the headwinds facing the eurozone. This could support the euro in the coming days.

The euro’s safe-haven appeal: In times of global unrest, the euro’s reputation as a safe haven currency may draw in investors. The euro may benefit from this in the days to come.

In general, it is challenging to predict with absolute certainty whether the euro would decline in the upcoming days. The euro may be supported by a number of variables, but it may also be weakened by a lot of other things. Before making any decisions about currency exchange, it is crucial to keep a careful eye on these variables and make sure you are aware of the hazards involved.

when did usd last surpass the euro? ( US Dollar vs Euro Predictions )

On July 12, 2022, the US dollar last outperformed the euro in value. 1 euro was worth 1.0039 US dollars on that particular day.

Since then, the euro has been falling in value; as of June 20, 2023, 1 euro is equivalent to 1.0918 US dollars. This indicates that during the past year, the euro has lost 9% of its value relative to the dollar.

The prolonged conflict in Ukraine, the delayed rate of monetary tightening by the European Central Bank, and the possibility of a European recession are just a few of the factors that have influenced the euro’s slide.

It is hard to predict when the euro will start to appreciate against the dollar. The euro could begin to gain, though, if the European Central Bank increases interest rates more quickly than expected.

for more information on US Dollar vs Euro Predictions keep reading our blogs.

Auther: allykazmi